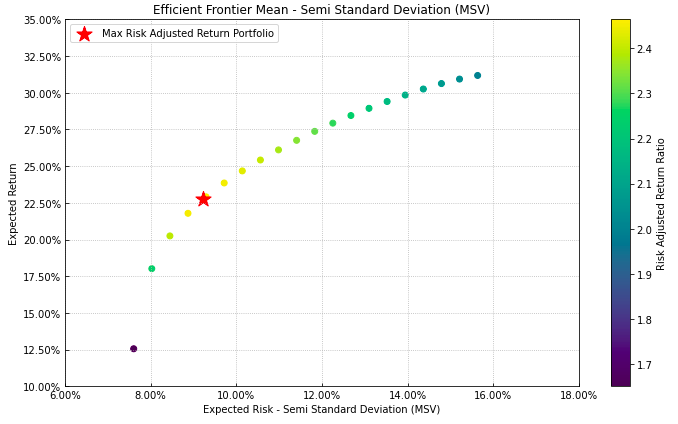

Returns are calculated using either the CAPM (an equilibrium pricing model) or a reverse optimizationmethod in which the vector of implied expected equilibrium returns () is extracted from knowninformation.1 Using matrix algebra, one solves forin the formula, = w, where w is the vector ofmarket capitalization weights is a fixed covariance matrix and, is a risk-aversion coefficient.2, 3 If the The Black-Litterman Model uses equilibrium returns as a neutral starting point. Positions concentrated in a relatively small number of assets. Theyĭemonstrate that these alternative forecasts lead to extreme portfolios portfolios with large long and short

Returns: historical returns, equal mean returns for all assets, and risk-adjusted equal mean returns. In a search for a reasonable starting point,Black and Litterman (1992) and He and Litterman (1999) explore several alternative forecasts of expected Portfolio's assets can force half of the assets from the portfolio.

However, Best and Grauer (1991) demonstrate that a small increase in the expected return of one of the The most important input in mean-variance optimization is the vector of expected returns (see Michaud (1989)) by spreading the errors throughout the vector of expected returns. According to Lee(2000), the Black-Litterman Model also largely mitigates the problem of estimation error-maximization The goal of the Black-Litterman Model is to create stable, mean-variance efficient portfolios,īased on an investors unique insights, which overcome the problem of input-sensitivity. On the Black-Litterman Model and focuses on the details of actually combining market equilibriumexpected returns with investor views to generate a new vector of expected returns. In addition to touching on the intuitionīehind the Black-Litterman Model, this paper consolidates critical insights contained in the various works Adding to the difficulty, the fewĮxisting articles lack consistency in their mathematical notations and no one article provides sufficientĭetail for establishing the values of the models parameters. Having attempted to decipher several articles about the Black-Litterman Model, I have found thatnone of the relatively few articles on the Black-Litterman Model provide enough step-by-step instructionsįor the average practitioner to derive the new vector of expected returns. Mixed estimate of expected returns.1 The resulting new vector of returns (the posterior distribution) isĭescribed as a complex, weighted average of the investors views and the market equilibrium. More assets with the market equilibrium vector (the prior distribution) of expected returns to form a new,

The Black-Litterman Model uses aīayesian approach to combine the subjective views of an investor regarding the expected returns of one or Paradigm, in which return is maximized for a given level of risk. Variance optimization and is the most likely reason that more portfolio managers do not use the Markowitz Input sensitivity is a well-documented problem with mean. Highly-concentrated, input-sensitive portfolios. The Black-Litterman asset allocation model, created by Fischer Black and Robert Litterman ofGoldman, Sachs & Company, is a sophisticated method used to overcome the problem of unintuitive, A STEP-BY-STEP GUIDETOTHE BLACK-LITTERMAN MODEL

0 kommentar(er)

0 kommentar(er)